closed end loan definition

A closed-end or closed mortgage bars a borrower from using their home as equity or collateral on a second loan and imposes prepayment penalties. The closed-end equity loan allows a borrower to stick with a fixed interest rate which may provide additional peace of mind.

Number and amount of installments 2.

. To qualify for a closed-end home equity loan the borrower will have a home appraised. It remains open and it permits the lender to make advances on the loan that are secured by the original mortgage. A closed-end home equity loan lets a homeowner take advantage of a homes equity to borrow money for debt consolidation home improvements and other significant expenses.

Closed-end fixed home equity loans are closed-end loans secured by the members dwelling. A conditional conveyance of property as security for the repayment of a loan. Many lenders allow homeowners to borrow up to 80 of a homes equity.

This format offers security for borrowers giving them a plan that they can reliably execute. Like a HELOC the closed-end second lien allows borrowers to take equity out of a mortgage for use in other areas. Closed-end loans are those loans in which the credit union agrees to loan a certain amount to the member.

A mortgage loan in which all sums have been funded at closingContrast with open-end mortgage in which the principal balance may increase over time. Closed end mortgage definition based on common meanings and most popular ways to define words related to closed end mortgage. Unlike open-ended mortgages there are no savings involved in paying off the closed-end mortgage.

A closed-end mortgage also known simply as a closed mortgage is one of the more restrictive home loans you can get. With this type of loan you cant. Definition of CLOSED-END LOAN.

These loans are normally disbursed all at 2. Closed-End Note means with respect to each Mortgage Loan which is a Closed End Loan a note in the form of Exhibit D attached hereto pursuant to which the related Mortgagor agrees to pay the indebtedness evidenced thereby which is secured by the related Mortgage. Section 10032 i defines a home improvement loan as a closed-end mortgage loan or an open-end line of credit that is for the purpose in whole or in part of repairing rehabilitating remodeling or improving a dwelling or the real property on which the dwelling is located.

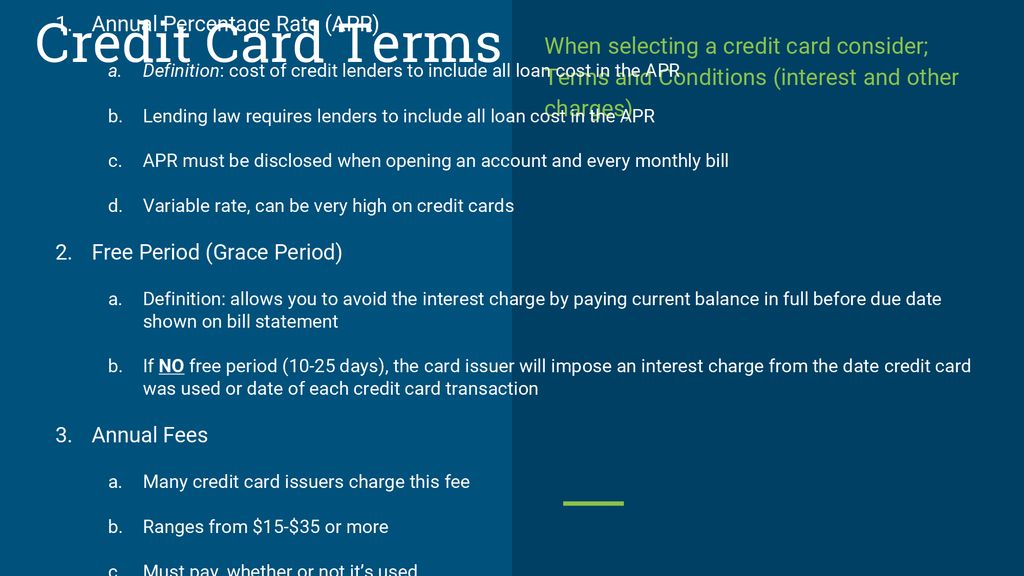

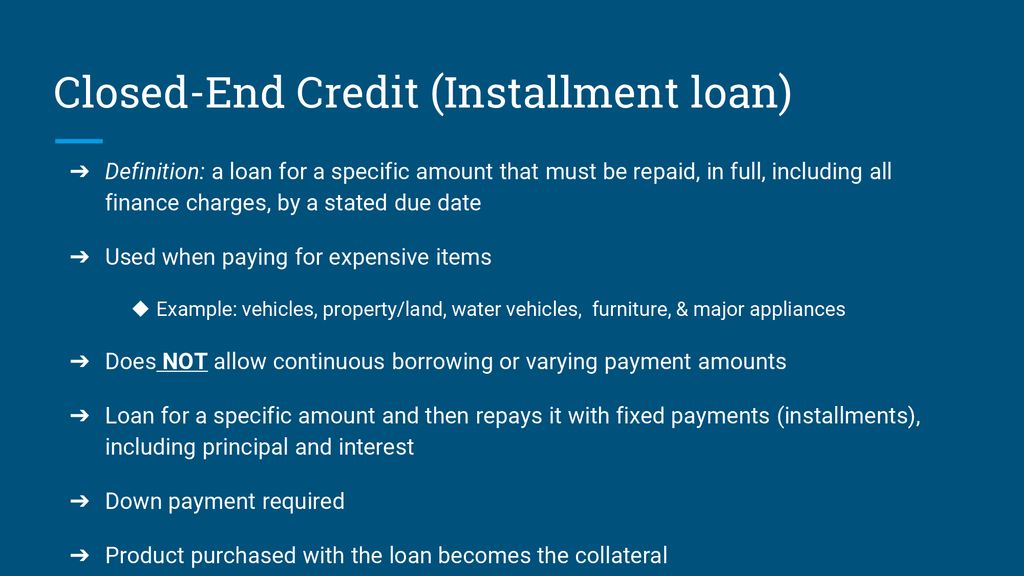

Ad-free experience advanced Chrome extension. A closed-end loan is a type of loan in which a fixed amount is borrowed and then paid back over a specified period. By contrast open-end loans such as credit cards can have the amount owed go up and down as the borrower takes money against a credit line.

Type of consumer installment loan where the borrower cannot alter the 1. Specifically the borrower cannot change the number or amount of installments the maturity date and the credit terms. A home loan is typically a closed-end mortgagea construction loan is typically an open-end mortgage.

The member cannot re-borrow any portion that has been paid back. Closed-end mortgages are mortgage agreements in which the full repayment of the loan cannot be made prior to the maturity date of the mortgages. In other words an open-end mortgage allows the borrower to increase the amount.

A closed-end mortgage is a mortgage agreement that does not permit a borrower to take an additional amount without repaying the current mortgage and taking permission from the mortgage lender. Closed-end credit is a loan or extension of credit in which the proceeds are dispersed in full when the loan closes and must be repaid by a specified date. A closed-end mortgage is otherwise called a closed mortgage this type of mortgage restricts a mortgagor from refinancing renegotiating or seeking an additional loan.

Auto loans and boat loans are common examples of closed-end loans. A closed-end mortgage loan or an open-end line of credit to improve a multifamily dwelling used for residential and commercial purposes for example a building containing apartment units and retail space or the real property on which such a dwelling is located is a home improvement loan if the loans proceeds are used either to improve the entire property for example to. A frequently used closed-end loan is a loan for purchasing a car.

Closed-end loan is a legal term applying to loans that cannot be modified by the borrower. Its circularity makes it more manageable as it doesnt have an end date. You get the open-end loan use the money.

An open-end loan is a more circular type of loan. An open-end mortgage allows individuals to borrow additional money on the same loan at a later date without having to take out new financing or credit. The member agrees to repay that amount over a stated period of time at an agreed upon interest rate.

Closed-end loans which include installment and student loans and automobile leases are generally charged off in full no later than when the loan becomes 20 days past due. A closed-end loan is a loan such as an auto loan with fixed terms and where the money is lent all at once and paid back by a particular date. A closed-end loan is a loan given with a specified date that the debtor must repay the entire loan and interest.

Unlike the HELOC the closed-end second lien sets a fixed interest rate and a specific payment schedule usually for 30 years. The amount of the money borrowed is fixed and the borrower pays it back in installment to the financing company. Maturity date andor 3.

2 i Home Improvement Loan. A closed-end loan restricts borrowers to a one-time payment of the amount borrowed but this type of loan will be the low-cost option to borrow against a homeowners home equity. If the borrower does negotiate a modification of the loan the borrower will be subject to penalties as determined by the lender.

Loan Structure Overview Components Examples

Understanding Finance Charges For Closed End Credit

Lesson 16 2 Types Sources Of Credit Ppt Download

Pin By The Project Artist On Understanding Entrepreneurship In 2022 Selling House Meant To Be Understanding

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

Lesson 16 2 Types Sources Of Credit Ppt Download

Dfiles Me Journal Entries Accounting Journal

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

Infographic The House Doesn T Always Win Racial Infographic Modest Proposal

Home Equity Loans Vs Home Equity Lines Of Credit Mid Hudson Valley Federal Credit Union

An Appraiser Is A Trained And Licensed Person Who Visits A Property Analyzes It And Determines Its Approximate Value In 2022 Vocab Real Real Estate

Lesson 16 2 Types Sources Of Credit Ppt Download

/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

/dotdash_Final_Amortized_Loan_Oct_2020-01-3a606fa9285943098248ac92e8d03b40.jpg)